In today’s Bureau Podcast, I reconnect with my former journalism colleague Jesse Ferreras. We both came of age as reporters in Vancouver and worked together at Global News, including on an investigation into some of the most significant figures in what became known as the Vancouver Model. We don’t walk through those cases in detail on the tape, but I’ve long believed some of the people we examined could and should be the focus of deportation orders from Canada — if Ottawa’s border and security agencies fully exercised their mandates. Quietly resolving those long-ignored files would, in my view, go a long way toward rebuilding trust with Washington, where officials remain deeply concerned about certain actors embedded in Vancouver’s financial and real-estate systems.

Our conversation turns on two main threads. First, we explore Jesse’s new work of fiction — a gothic horror story set in Vancouver real estate, a kind of clash-of-civilizations tale rooted in the city’s housing market. Second, we talk about how both of us, as reporters, leaned heavily on the data and analysis of B.C. urban planner Andy Yan to understand how foreign capital has dominated and distorted Vancouver’s housing market. Yan’s work on glaring income-to-home-price “incongruities” helped me see that what I once called the Vancouver Model had grown into something much larger: the “Canada Model.”

The podcast goes deeper into Jesse’s story.

Here in the notes, I want to unpack a bit more of Andy Yan’s seminal research, and how it intersected with confidential datasets and banking disclosures I later obtained. Two years after my 2023 investigation, the U.S. Treasury has now identified the same global Chinese underground money-laundering typologies I reported on, in a major dataset that tracks roughly $300 billion in Chinese money laundering for Mexican narco-cartels over the past four years—including more than $50 billion tied to real-estate laundering.

Yan’s earlier Vancouver mortgage work supported my deep dive in Toronto, showing that the same suspicious Chinese real-estate mortgage patterns he identified in Vancouver had also become deeply embedded in eastern Canada, inside Canada’s largest banks, with virtually no enforcement response.

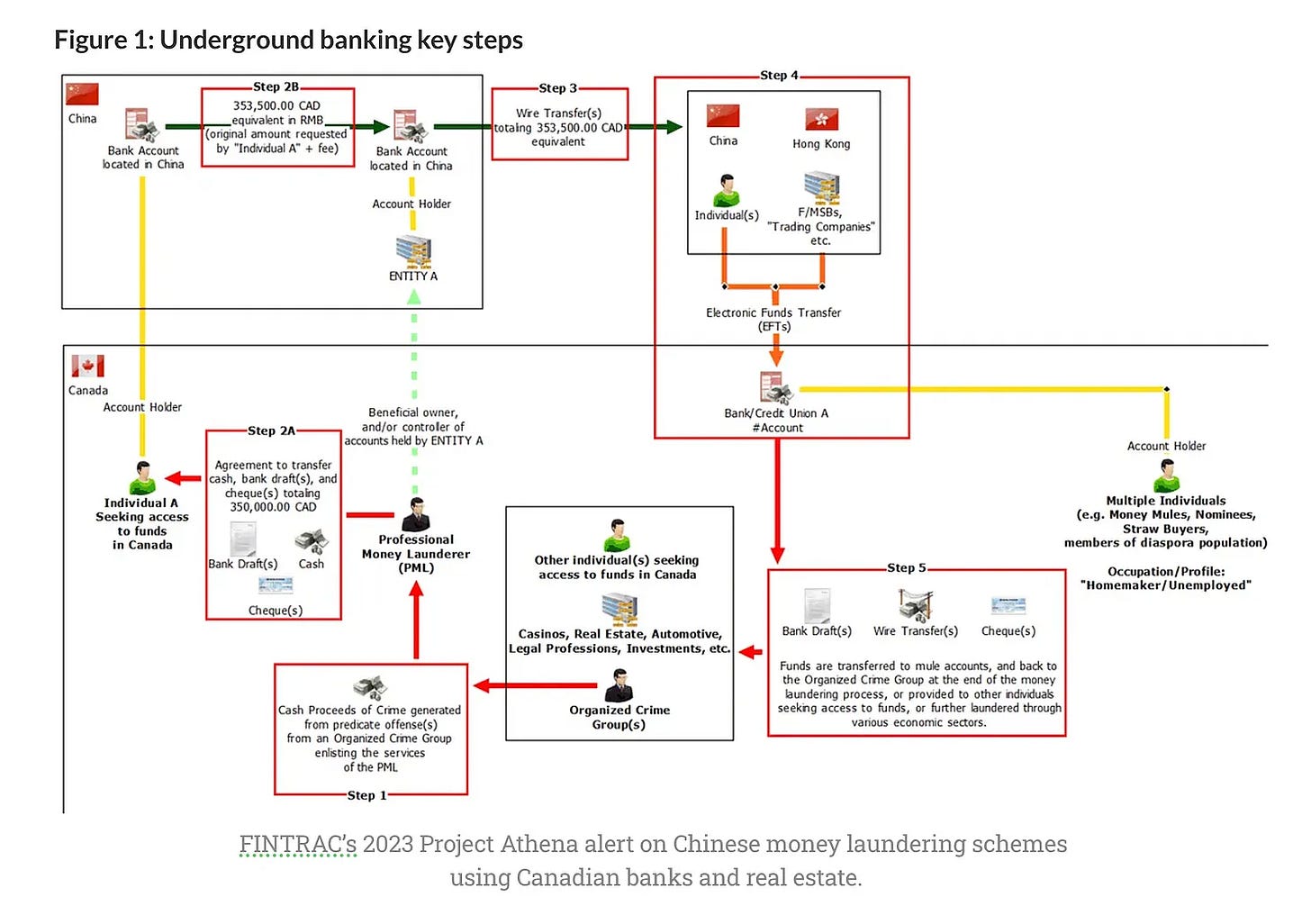

My reporting also drew on FINTRAC’s release of a sweeping analysis of 48,000 transactions involving members of the Chinese diaspora. That study revealed massive wire transfers from Hong Kong and Mainland China moving through “money mule” accounts held by students, homemakers, and shell companies—including law firms. In a nutshell, FINTRAC found that during the pandemic, massive money laundering through Vancouver-area government casinos evolved into Canadian bank accounts, law office accounts, real-estate developer accounts, and more complex electronic transaction paths.

For me, the findings showed that FINTRAC, a division of Canada’s Ministry of Finance, had complete visibility into how Canada’s banking system was being exploited at scale by Chinese transnational crime networks. At the same time, this raised serious alarms about Canada’s banking oversight, because FINTRAC’s data led to no Canadian police prosecutions and only a few minimal fines in the range of millions against several banks, including TD Canada. FINTRAC’s patterns overlapped neatly with the U.S. Justice Department’s US$3-billion TD Bank case, where international students from China and Beijing-linked United Front networks played central roles in laundering drug proceeds, according to former U.S. investigator David Asher.

At the heart of my exclusive story on mortgage fraud was reporting sourced from an HSBC Canada whistleblower, who uncovered dubious Toronto-area mortgages propped up by fabricated, high “remote-work” salaries from China. The types of mortgages the whistleblower discovered—fake job titles, faked massive incomes, failed banking due diligence—in my analysis, explained the patterns behind the data that Andy Yan first uncovered in Vancouver, that FINTRAC examined in 2023, and that the U.S. Treasury flagged again in 2025.