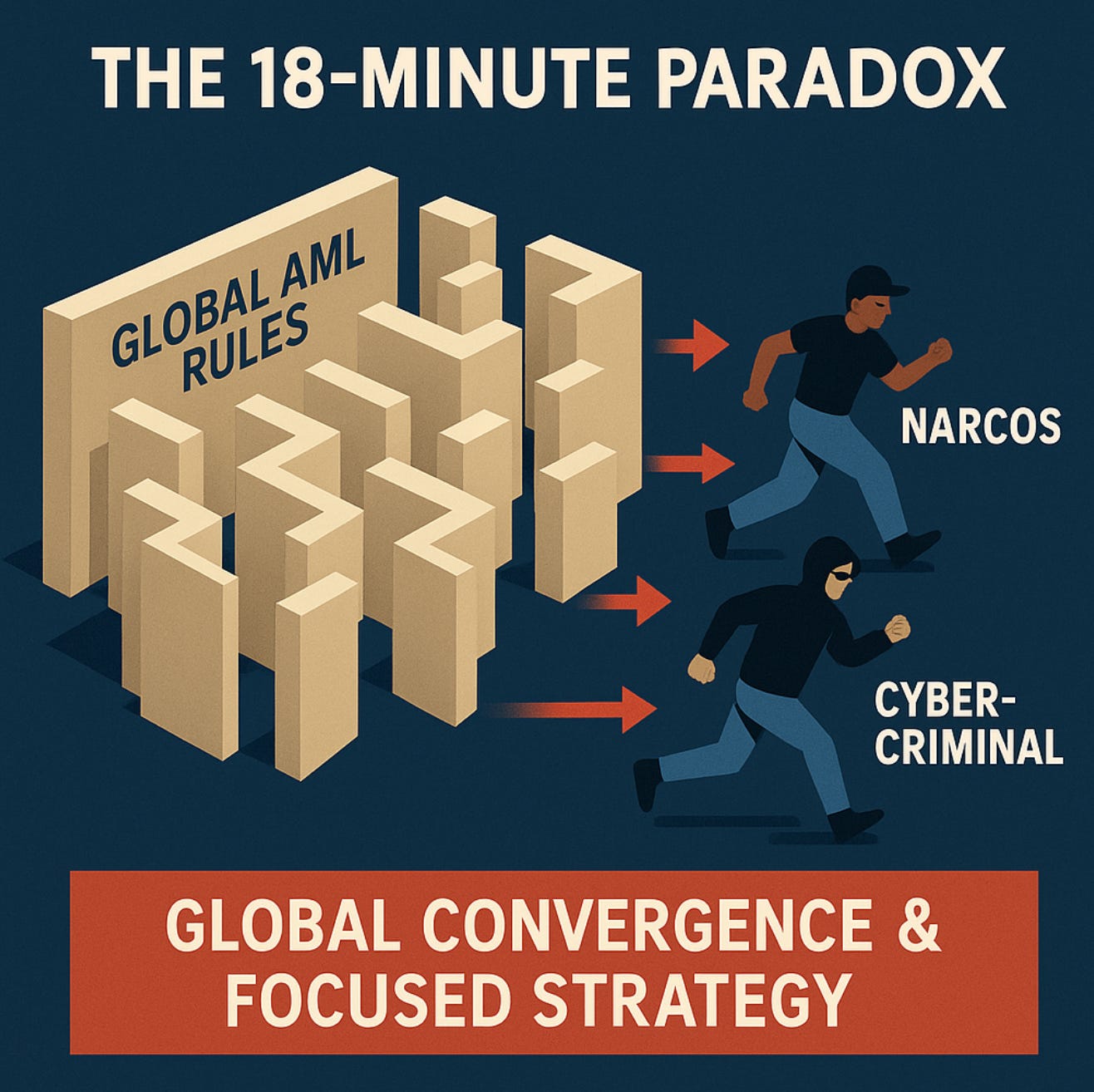

The 18-Minute Paradox: How Rapid-Fire Global AML Rules Create a Patchwork Criminals Exploit

Only global convergence and a focused strategy can turn regulation from box-ticking into a true weapon against transnational organized crime.

Keep reading with a 7-day free trial

Subscribe to The Bureau to keep reading this post and get 7 days of free access to the full post archives.