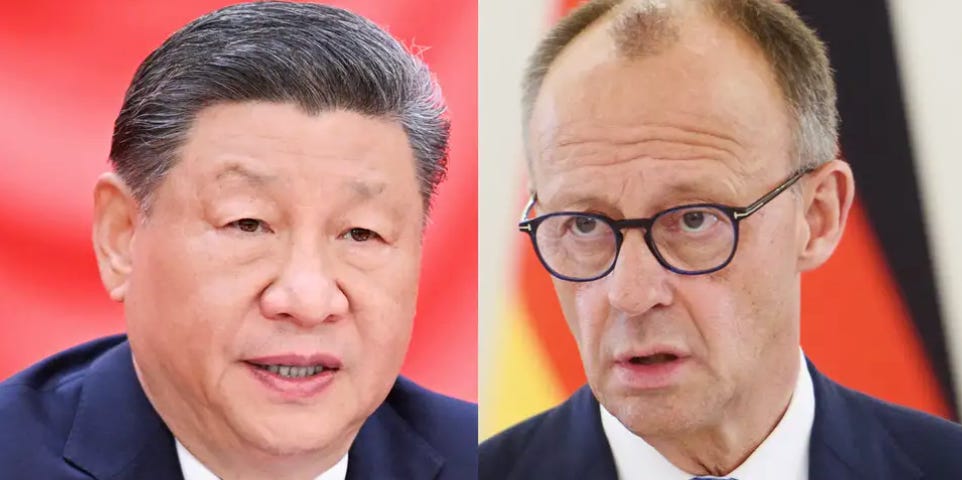

German machinery lobby to Merz: China isn't a partner, it's a competitor — and it's cheating

Fix the playing field or face consequences: Germany's industry lobby sets Chancellor an agenda for Beijing.

FRANKFURT — Germany’s powerful mechanical and plant-engineering lobby, VDMA, has urged Chancellor Friedrich Merz to demand that China end its use of rare earth export controls as a “political power tool” and dismantle a web of systematic market distortions during his upcoming trade mission to Beijing, warning that German exporters are losing ground as Chinese competitors expand at home and abroad.

In a statement shared with The Bureau today, the association said the chancellor should signal that Germany and the European Union still want “constructive” cooperation with China — but only on “fair competitive conditions,” which it described as a basic prerequisite for any further partnership.

The numbers the VDMA presented were stark. German machinery exports to China fell 8.5% from January to November 2025, while machinery imports from China rose 12.5% over the same period. “Our companies are coming under increasing pressure because key competitive conditions are being systematically distorted,” the association said.

The VDMA’s executive director, Thilo Brodtmann, laid out a blunt list of demands for Merz to raise in Beijing.

He called on Chinese leaders to stop propping up so-called “zombie” firms — permanently loss-making companies kept alive by state subsidies that produce prices no market-based competitor can match. He demanded a broader reduction in industrial subsidies, noting that China’s industry receives state support at four to five times the rate of other major economies. “As a result,” the association said, “German companies are not competing with other companies, but with the Chinese state treasury.”

The message to Merz was unambiguous: press Beijing to correct these distortions, or Europe will act unilaterally. “If China does not correct these distortions itself,” the association warned, “Europe will take further measures of its own to restore fair competitive conditions.”

Merz has framed the Beijing trip as part of a search for “strategic partnerships” at a moment when Donald Trump is leaning heavily on tariffs — language that underscores the tightrope Berlin is walking: preserving access to a crucial market while responding to domestic pressure to “de-risk” supply chains and to toughening U.S. trade defenses.

The VDMA’s intervention lands amid renewed alarm across German industry that China is no longer simply a market — it is an increasingly predatory competitor.

Some security analysts go further, arguing that market access functioned as a strategic inducement Beijing extended to German manufacturers before absorbing their leading technology, replicating it, and displacing them first in China and then in global markets. The federation’s own reporting has described German machinery exports as squeezed by tariffs and weak global investment, with shipments to China down 8.8% year-over-year from January to September 2025.

Nowhere is the political sensitivity greater than in the automotive sector.

Over decades — especially during Angela Merkel's 16 years in office and extended under Olaf Scholz — German carmakers made China central to their growth strategies, building deep joint-venture footprints and relying on the Chinese market for scale.

But the payoff has narrowed sharply as Chinese brands surged in electric vehicles, aided by industrial policy and an intense domestic price war. Volkswagen, long the emblem of German dominance in China’s car market, has seen its position erode further: data cited by the China Passenger Car Association show Volkswagen’s retail market share across its two main Chinese joint ventures fell to 10.9% in 2025, after it lost the top spot to BYD in 2024 and was then overtaken by Geely Auto in 2025.

The strategic risk was underscored by Michael Kovrig, the former Canadian diplomat and China analyst who was detained by Chinese intelligence in December 2018 in what was widely seen as retaliation for Canada’s arrest of Huawei executive Meng Wanzhou, and who was released in a prisoner swap in September 2021.

“As German Chancellor Friedrich Merz prepares to visit China next week, Europe’s not doing enough to counter Beijing’s coercive policies,” Kovrig wrote on X on Friday. “China’s coercion toolkit deploys hostage diplomacy, trade barriers, and supply chain chokeholds to force obedience. German policy is trapped between fear and greed. Merz must seize this opportunity to chart a new direction.”

On public procurement, the VDMA was equally pointed: China grants locally producing companies a systematic 20% price advantage on public contracts, it said — a practice the association said “clearly violates WTO principles” and amounts to structural discrimination against international suppliers. On rare earths, Brodtmann accused Beijing of weaponizing export controls as a “political power tool” to put foreign companies and governments “under targeted pressure,” and demanded reciprocity. “We do not withhold products on which China is dependent,” the statement said, “and expect the same reliability.” And on currency, the VDMA cited an undervaluation of the yuan of up to 40%, which it said hands Chinese exporters a vast and artificial price advantage.

German businesses operating in China increasingly describe the playing field as tilted. A survey reported by Reuters found nearly two-thirds of German firms in China said they faced unfair competition, with respondents citing disadvantages in access to authorities, information and licenses, as well as relentless price pressure and mounting market-share losses.

One cannot be a partner with someone who has no honour, decency or a respect to the Rule of Law.

Let’s be very clear, they operate as a mob / triad organization. Trump knows this , it’s evident in behaviour and if left unchecked , well you know how that unfolds