Bankers verified Fake Chinese Income mortgages for banned money laundering suspects in Toronto: HSBC Leaks

International Bank "Offshore Verification Team" allegedly confirmed forged Chinese docs

In September 2020, as Ontario’s real estate rocketed higher, a Toronto realtor with ties to Beijing claimed a fake Chinese income of $763,689 in order to secure HSBC mortgages for two properties, bringing her personal portfolio in Greater Toronto up to five homes.

What makes this realtor’s case politically explosive is not just that her network allegedly laundered money from China into Toronto real estate, nor the forged Chinese employment records they used to obtain massive mortgages from Canadian banks, or that they became Ontario landlords by leveraging criminal underground banks servicing Chinese diasporas in Vancouver and Toronto.

Jolting revelations from this case that take The Bureau’s investigation into Canada’s housing affordability crisis to a new level include:

An HSBC major financial crimes probe triggered by a whistleblower found the bank’s offshore verification team and Aurora branch staff wittingly approved fake income mortgages for the realtor in 2020 after HSBC “exited” her family for money laundering concerns in April 2016;

The realtor — whom The Bureau is calling Ms. D — easily obtained mortgages from Big Five banks immediately after HSBC Canada exited her in 2016, indicating fake Chinese income networks are operating across Canada’s banking sector;

Canada’s financial regulators including OFSI and Fintrac and also RCMP understand the multi-billion-dollar scale of money laundering flooding into Canada’s banks and real estate from corruption-prone states including China and Iran but regulators aren’t sufficiently empowered to intervene.

Ms. D’s case only surfaced because during the pandemic an HSBC whistleblower, whom The Bureau is calling D.M., uncovered what he believes is systemic mortgage fraud involving Chinese diaspora clients and HSBC Toronto-area branches.

The fraud enabled real estate investors and landlords across Toronto to secure at least $500-million in questionable mortgages since 2015, D.M. calculated, by claiming massive, fake incomes in China.

And fake Chinese remote-work mortgages exploded during Covid-19, D.M. discovered, which compelled him to alert bank executives in April 2022.

The whistleblower informed his bosses the fraud was sophisticated and likely involved HSBC Canada staff and scam centres in China that verified fake banking and employment records.

The Bureau’s investigation finds D.M.’s allegations are not only plausible, but fit into a much broader examination by Fintrac, which studied 48,000 transactions during the pandemic.

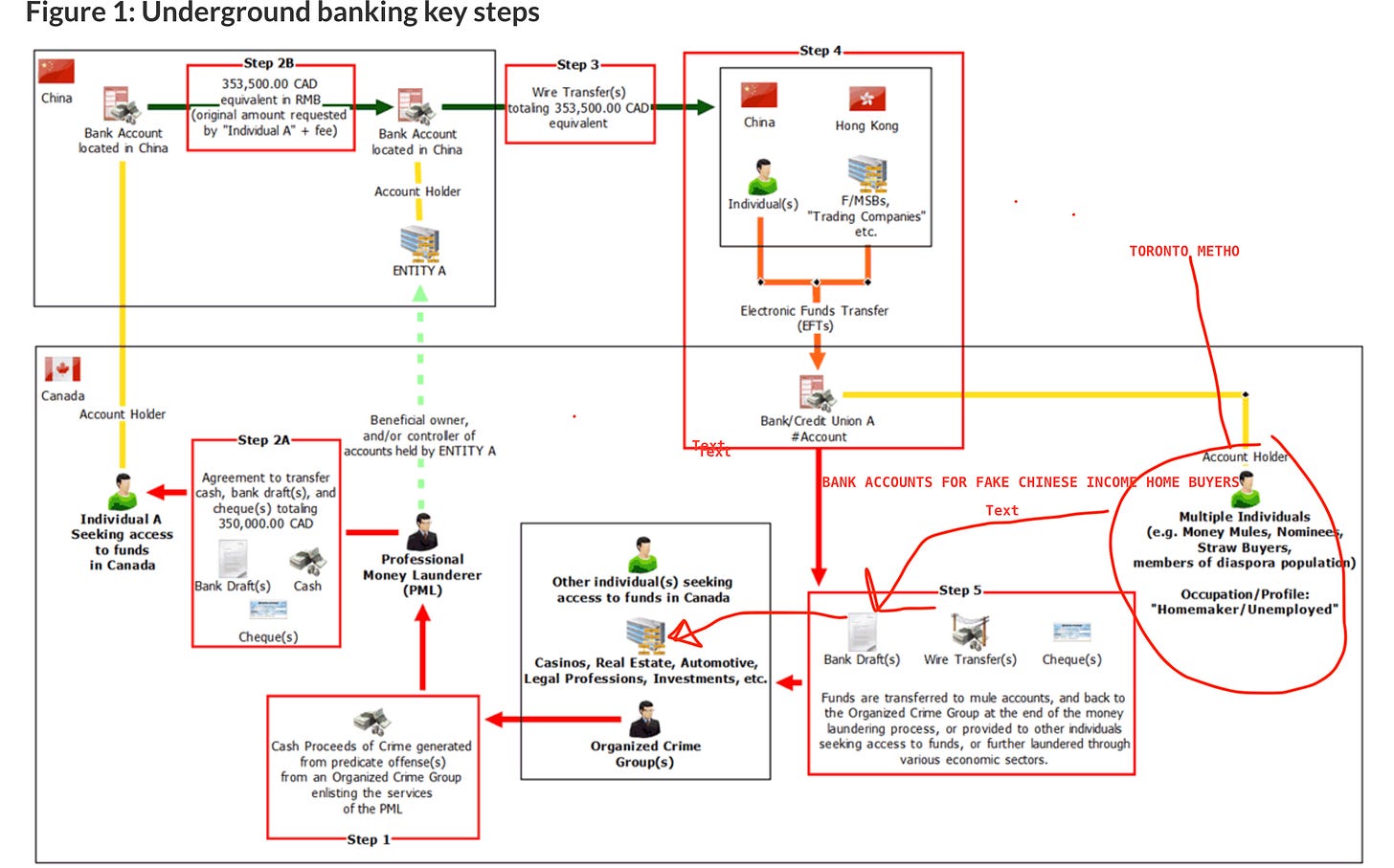

Fintrac discovered evolving Chinese diaspora money laundering networks used wire transfers from Hong Kong into Canadian bank accounts to fund home mortgages for offshore and diaspora buyers.

Canadian banking mortgages taken by “money mules” in the diaspora became the focus of Chinese transnational money laundering because government casinos were closed in the pandemic, Fintrac reported in 2023.

“Funds going through the real estate sector were sent to individuals involved in property management, real estate development, real estate agents, sellers, brokers, real estate consultants, mortgage brokers,” Fintrac said.

Its groundbreaking 2023 report added “mortgage payments are sourced from incoming funds from China,” and “bank accounts of suspected money mules demonstrated in-and-out activity, with a high volume of cash deposits or large incoming wire transfers from parties located in China, whose relationship is unknown.”

But leaked banking documents resulting from D.M.’s internal complaint about Ms. D and another HSBC client that claimed a $700,000 fake Chinese income, prove this “Toronto Method” of real estate money laundering actually started from at least 2013.

“This case is an example of Mainland China participants in money laundering,” D.M. said in an interview, “using a Chinese bank to create wealth and convert black money into white.”

Teacher from Beijing

After D.M. emailed a senior bank investigator in May 2023 warning he had “strong evidence” of mortgages “obtained with fake docs” HSBC Canada launched a major financial crimes probe that lays bare Chinese transnational fraud networks.

The resulting July 2023 “external fraud” report raises broader concerns than systemic mortgage fraud at HSBC Canada, though.

It suggests even if Canadian banks “exit" clients involved in Chinese transnational money laundering, bad actors simply transfer their funds through accounts of other community members, using them as conduits to secure new mortgages at different banks.

Ms. D’s initial financial bridge from China into Canada involved a number of HSBC China accounts, according to the July 2023 HSBC Canada “external fraud” report reviewed by The Bureau.

Claiming to be a school teacher from Beijing, she opened her Aurora branch account in June 2013, the report says.

In January 2014, funds from third parties in China started to flood into her Aurora HSBC account. Within 18 months Ms. D and her husband had recieved 23 wire transfers, totalling $651,959 in Chinese funds that HSBC Canada couldn’t determine the sources of.

Eventually in 2016, an internal investigation found that cash from HSBC China and other Chinese banks had flowed through Ms. D’s account to third parties that apparently used high-value cheques to fund real estate purchases, which indicated money laundering.

And so, Ms. D was “exited in 2016 due to concerns regarding the receipt of wires from multiple third parties and the flow through activity in her account, which appeared to be used a conduit to move funds from one jurisdiction to another,” the July 2023 “external fraud” report says.

And yet in May 2016 — one month after HSBC Canada cut Ms. D off — TD Bank and Royal Bank of Canada issued mortgages for her.

“At least two of the properties appear to be rented out and the mortgages for those properties are currently held with TD and RBC,” HSBC Canada’s July 2023 report says.

“Property records show that the TD mortgage was placed on the house in May 2016. TD has confirmed that, according to their records, which were last updated in 2016, [Ms. D] was unemployed,” the report says. “The RBC mortgage was also granted to [Ms. D] in May 2016. According to RBC records, [Ms. D] is listed as a homemaker.”

The Bureau asked HSBC Canada and RBC to respond to allegations in HSBC’s July 2023 fraud report.

HSBC didn’t respond to questions for this story. RBC purchased HSBC Canada in a deal approved by Canada’s Finance Minister Chrystia Freeland in December 2023.

“We have no comment,” RBC’s senior director of communications Gillian McArdle wrote in an email.

In interviews for this story, D.M. explained that he discovered explosive loan growth at the Aurora HSBC branch in 2020, which he attributed to fake Chinese remote work scams. The bank issued tens of millions in loans that year exclusively to Chinese diaspora clients based on forged documents that were verified by staff, D.M. alleged.

The July 2023 fraud report and other documents obtained by The Bureau support D.M.’s conclusions.

While Ms. D first “onboarded” with HSBC Canada in 2013, claiming to be a teacher in Beijing, she returned to the Aurora branch in September 2020, using the same name and driver’s license.

This time, she told Aurora branch staff she was vice-general manager of a medical technology company in China.

“According to the application, [Ms. D’s] annual income is listed as CAD $763,689.97 and she has been with the company since November 1, 2016,” HSBC’s July 2023 external fraud report says.

Branch comments on her credit application said Ms. D wanted to buy one property near her children’s private school in Toronto as well as a weekend property in the affluent suburb of Oakville.

“[Ms. D’s] credit application contained detailed branch comments explaining how she is able to be employed as the Vice General Manager of a medical technology company based in China while living in Canada,” the July 2023 fraud report says

It added branch staff claimed Ms. D had “more than 10 years of experiences in the same industry; therefore, she is able to manage her work via emails and conferences while she is spending time with her family in Canada."

And Ms. D’s “income documents and bank statements were verified by the Offshore Verification Team.”

The problem, HSBC Canada’s July 2023 report says, is Ms. D’s forged Chinese income information was provably false based on HSBC Canada client files and documents from other Canadian banks.

“Although [Ms. D] has provided supporting documents as evidence for her employment in China, they contradict the employment details in [her] original profile as well as employment information held on file for her at three other financial institutions,” the report says.

And Ms. D’s original claim of working for 15 years in China as a teacher “directly contradicts the branch's claims that she was able to work remotely for the medical company in China given her many years of experience in the industry,” HSBC Canada’s fraud report says.

While HSBC Canada didn’t respond to questions for this story, in a previous statement spokeswoman Sharon Wilks wrote: “We will not do business with individuals or entities we believe are engaged in illicit conduct. We can and do regularly exit relationships with clients whose activities we deem too risky.”

The Bureau provided HSBC’s July 2023 investigative report to RCMP and Fintrac, asking both to answer whether they have ever investigated banking staff and clients for collusion in real estate mortgage fraud and money laundering in Canada.

“FINTRAC is strictly prohibited from disclosing information on compliance actions that may or may not have taken place in relation to a specific business,” the agency responded. RCMP said it “can only confirm the existence of an investigation or the identity of those involved in the event that criminal charges have been laid.”

In November 2023 — several weeks prior to Deputy Prime Minister Freeland’s final approval of RBC’s purchase of HSBC Canada — Fintrac and OFSI, Canada’s banking regulator, did not respond to repeated questions from The Bureau citing evidence from the HSBC whistleblower.

Money Laundering Landlord suspect

In order to investigate D.M.’s fraud allegations HSBC Canada searched land titles to discover how many properties Ms. D’s family held in Ontario, and how they were funding Canadian bank mortgages.

The examination turned up facts that raise concerns about Toronto’s tight rental market.

After scoring multi-million-dollar mortgages from HSBC in October 2020, based on her massive, provably fake Chinese income of almost $800,000 annually, Ms. D owned at least five houses.

“At least two of the properties appear to be rented out and the mortgages for those properties are currently held with TD and RBC,” HSBC Canada’s July 2023 report found.

D.M. says the investigation showed Ms. D worked as a realtor in Toronto, which contradicted not only what she claimed to HSBC Canada, but also other banks.

“According to RBC records, [Ms. D] is listed as a homemaker,” the July 2023 report says.

It adds HSBC’s financial crimes team probed Ms. D’s transactions from October 30, 2020 to May 2, 2023, the day that D.M. flagged her new mortgages.

“During that time, the account was funded almost exclusively by mobile cheque deposits,” the probe found, “with 46 mobile cheque deposits made to the account for a total of CAD $362,199.27, the majority of which appear to be rent cheques from three separate renters.”

The investigation also noted “a single cheque for CAD $300,000 that was deposited at account opening and drawn on [Ms. D’s] own account at BMO.”

And there were seven cheque deposits for a total of $110,000 from another BMO customer, Ms. S, who had also opened an HSBC Canada account in 2019, and listed the same residential address as Ms. D.

“[Ms. S’s account] appears to have been set up as a means to move her own funds, as well as [Ms. D’s] from one financial institution to another,” the July 2023 report says.

It noted this same client, Ms. S, was one of the “third parties” in China that wired funds into Ms. D’s HSBC Canada account in 2014.

Documents show that Ms. D sold one of her HSBC mortgaged homes in 2021.

In an interview the whistleblower, D.M., said the Toronto realtor was also contemplating paying off her remaining $2-million mortgage with his Aurora branch in 2023.

“Please tell me that is not money laundering, within about a year you are paying off such a huge mortgage,” he alleged. “Then they sell it and not only have they created profit but also converted their black money from China into legal white Canadian dollars.”

A federal policing expert that was not authorized to comment publicly agreed, calling the Toronto Method cases revealed in D.M.’s bank leaks “classic” money laundering.

“Get nominees to get the mortgages. They are given money or the mortgage payments are getting taken care of,” the source said. “Few years later that house is sold. Equity cashed out. Money washed.”

The police source added that “student” money mules identified in Fintrac’s 2023 examination of Toronto Method real estate money laundering are also used to buy luxury vehicles in Canada for Chinese Triads.

These vehicles are shipped to China and sold for up to five times the value, the source said, with the proceeds used to ship narcotics precursors back into Canada.